Educating South Florida Real Estate Consumers

One of the primary goals for the Buy South Florida Real Estate Blog is to be a valuable resource for the South Florida real estate market. From time to time, I will invite market experts to write a post providing you important updates on these experts’ area specialties. For this post I have invited expert South Florida Mortgage Banker, James Venney to offer this timely mortgage market update.

Knowledge is Power!

James is very knowledgeable in the mortgage industry and is up to date on the continually changing industry especially here in South Florida. I have invited James to offer his insight on the current trends in the mortgage market. Empowering you with timely mortgage information, after reading this post, we welcome your comments.

Effects of the Backlash in the Mortgage Crisis

The “mortgage crisis” is now more than 12 months old and we are still experiencing significant daily volatility in interest rates as well as significant underwriting guideline changes. Most notable of the recent changes in the availability of mortgage products is the elimination of mortgage insurance for condominiums in the state of Florida. As many of you know mortgage insurance is required when making less than a 20% down payment. The one exception to this is FHA which can be utilized for FHA approved condos with as little as 3% down. If the condo building in question is not FHA approved, FHA “spot approvals” can be pursued but are not typically granted on buildings with a high concentration of investor owned units.

“The Big Four” Down Payment Expectations

Additionally 20% down payments are being required by “the big four” (Wells Fargo, Citibank, Chase and Bank of America) for jumbo purchase and refinances with loan amounts up to $1 million and 25% down for loan amounts greater than $1 million. Rest assured that what ever “the big four” are doing the smaller lenders are doing as well.

Current Interest Rate Environment:

Interest rates remain near historic lows with conforming 30 year fixed rates in the low 6% range (conforming loans are those of $417,000 or less) and Jumbo 5 year adjustable rates in the high 6% range (Jumbo loans are those of greater than $417,000).

Rate Lock Forecast:

Short-term Rate Volatility

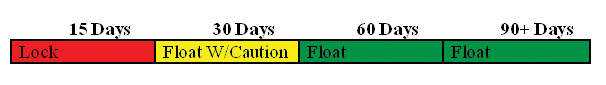

Expect continued volatility with the possibility of frequent “intra-day” re-prices. As indicated in the float vs. lock meter above, I have a locking bias for those transactions closing in the next 15 days and only recommend floating for those transactions closing in the next 30 days with caution and daily updates on the direction of interest rates.

Rates Follow the Lead of Yields

The mortgage backed securities market will take its cues from the stock market with extreme sensitivity to any economic news that indicates that inflation maybe creeping into the economy. Remember “as go yields go interest rates” so any news that shows the economy is slowing or any significant down days in the stock market will be a prelude to lower mortgage interest rates in the short term.

James R. Venney CMP, CMPS

Mortgage Banker / Certified Mortgage Planner

HomeServices Lending An Affiliate of Wells Fargo Bank

305-960-2671 phone

866-577-6971 E-fax

Email James Venney

www.PreApprovalPro.com

I must tell you that overall I am very taken with this blog.You evidently know what you are speaking about as you write with passion. If I had your writing ability, I know I would be a success. I have bookmarked your web site and look forward to additional updates.